Renters Insurance in and around Los Angeles

Get renters insurance in Los Angeles

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

There's a lot to think about when it comes to renting a home - internet access, parking options, number of bedrooms, townhome or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Los Angeles

Renters insurance can help protect your belongings

Why Renters In Los Angeles Choose State Farm

The unexpected happens. Unfortunately, the valuables in your rented townhome, such as a cooking set, a couch and a tablet, aren't immune to tornado or break-in. Your good neighbor, agent Gregory Kim, is committed to helping you choose the right policy and find the right insurance options to help keep your things protected.

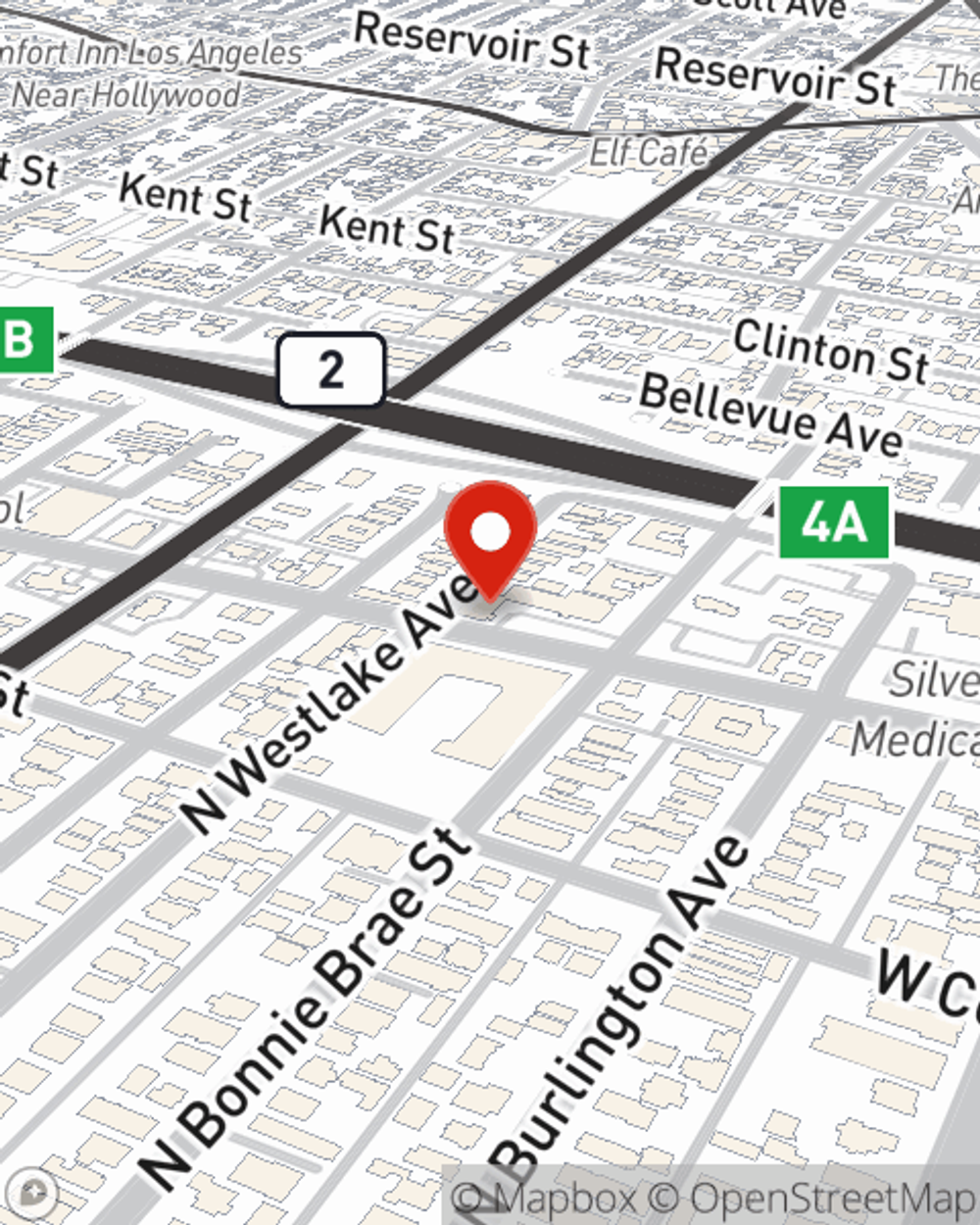

Call or email State Farm Agent Gregory Kim today to check out how the trusted name for renters insurance can protect your possessions here in Los Angeles, CA.

Have More Questions About Renters Insurance?

Call Gregory at (213) 388-4955 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Gregory Kim

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.